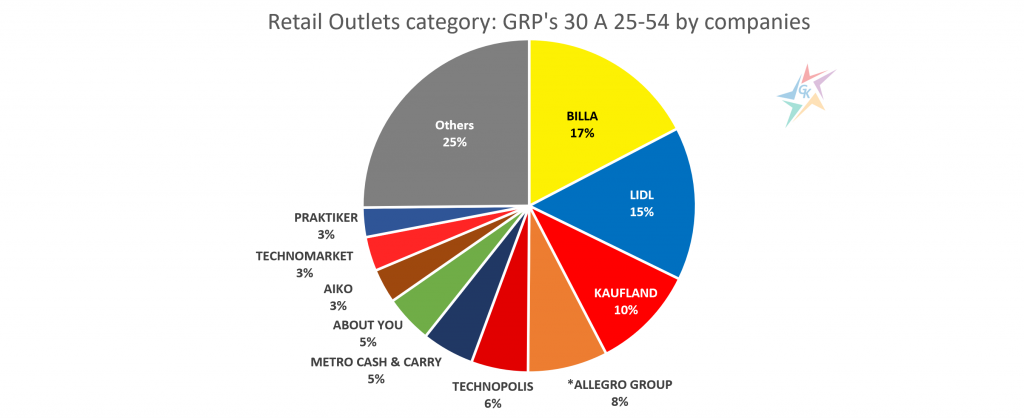

In the last year we have witnessed a rapid transformation of the business into a new reality. Much of it responds to emerging customer needs by moving to an online environment and expanding its portfolio of goods and services. These changes did not go unnoticed by the participants in the category “Retail outlets”, which is one of the largest and fastest growing in 2021. More and more online platforms continue to join the standard retail chains, offering everything you need at a click away from users. This trend is also being successfully adopted by the standard physical stores, many of which have made their products available for online shopping. To these two segments is added a third, whose activity is to connect physical stores with customers, delivering the desired products to the door (BG Menu, Foodpanda, Glovo). Despite the difficult division and categorization of the main activity of the participants in the sector, in the following chart we answer the question who are the biggest advertisers in the “Retail Outlets”:

The chart illustrates the top 10 advertisers in the category for the first four months of the year based on the reported weighted GRP’s 30 for target group A 25-54. To assess their development, we also added in tabular form the results for the same period for 2020:

This year, the leading positions are reserved for the established retail chains of stores BILLA, LIDL and KAUFLAND. Serious growth was recorded by BILLA, 40% above the GRP’s 30 in January-April 2020, which took it to the first position in the ranking for 2021. LIDL lost the lead, registering 3% decrease compared to the same period in 2020. KAUFLAND’s communication on television also declined, but the company still maintained its position. METRO CASH & CARRY is the latest FMCG chain to participate in the ranking of the largest advertisers in the sector. The company recorded 18% growth and thus managed to maintain last year’s sixth position in “Retail Outlets” category.

Fourth place in the ranking is occupied by ALLEGRO GROUP, which represents emag.bg, fashiondays.bg and olx.bg. Here it is important to note that since February this year, the official TV monitoring system – GARB, transferred their activities from the category “Telecommunications” to “Retail outlets” and in the table they participate with their results for the period February-April 2021. In order to provide an objective information regarding their performance, below the table is described the data from the communication of the company as a whole for both considered periods. From these figures it is clear that in the first four months of the year their activity in television increased by 21% compared to the same period in 2020. Another representative of online commerce in the ranking is ABOUT YOU. The company is a new advertiser, launched its television activity in the fall of 2020 and is focused on online marketing of famous fashion brands. It quickly took a share, reaching seventh place in the rankings. The companies in question are far from the only representatives of the online commerce that are on TV. The list of active advertisers also includes EOBUWIE.PL (obuvki.bg and modivo.bg), VIVRE DECO, ANSWEAR.COM, BG MENU (takeaway.bg), FOODPANDA and many others.

There is a shift in the arrangement of the advertisers of household appliances. TECHNOPOLIS increased its GRP’s 30 by 9%, but still fell by a position down from January-April 2020. TECHNOMARKET is the other store specializing in the sale of appliances, which is present in the top 10, but recorded a 32% decline and accordingly occupies the ninth place, which is four positions down. In the first four months of the year, both ZORA and MAGNUM-D (TECHMART) have activities, but their performance ranks them below the top ten.

More and more often we are used to seeing on TV furniture stores that promote their goods with attractive offers and prices. For the period January-April 2021, the only representative who enters the top 10 is AIKO, with a 2% increase in GRP’s 30 and a position down from 2020. It is interesting to note that their communication is divided between the brands AIKO and MOMAX. Other representatives of the category that do not fall in the rankings, but also have a presence on TV are VIDENOV GROUP and IKEA.

PRAKTIKER is one of the advertisers with significant growth in January-April 2021, 32%. This investment places it in the group of top advertisers in this category and gives it an advantage over competitors such as DOVERIE BRIKO (Mr. Bricolage) and HOMEMAX-X.

The top ten companies form almost 75% of the total results in the category. All after the tenth position, a total of sixty active advertisers, generate the remaining 25%. This year, the growth of the group “Others” is almost double and one of the reasons behind is the increase in the number of active participants in the category.

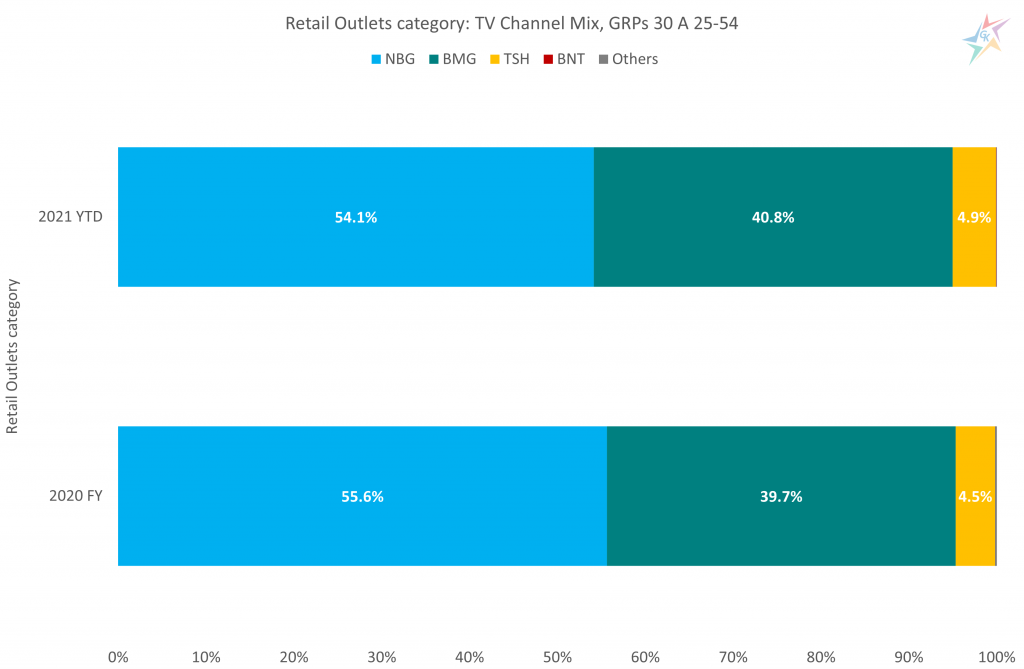

Regarding the mix of TV channels used for communication, we can summarize that there is no noticeable change:

About 55% of total GRP’s 30 in the category are achieved by the TV channels of Nova Broadcasting Group (NBG), followed by a 40% share of the TV channels of bTV Media Group (BMG) and a 5% share of the TV channels represented by Sales House (TSH). The share of TV channels from the state owned BNT, as well as TV channels that are not part of a large group is below 0.2%.

For additional information, please contact our team via the contact form.